Datacenter Trends

Hyperscale Datacenters Surprise with 'Staggering' Growth in Q1

Even on the heels of a breakout 2017, the world's biggest datacenter operators -- among them Google, Microsoft and Amazon Web Services -- have outdone themselves.

- By John K. Waters

- 06/07/2018

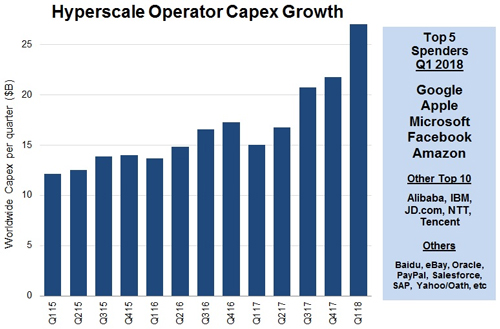

The datacenter market has been booming since 2012, but recent hyperscale investments fueled unexpected explosive growth in the first quarter of this year, with hyperscale capital expenditures (capex) skyrocketing to $27 billion, analysts at Synergy Research Group reported.

Although 2017 was a standout year for hyperscale capex, said John Dinsdale, chief analyst and research director at Synergy, the first quarter of this year has seen what he called "staggering numbers."

"Our detailed quarterly market tracking has consistently shown strong growth in cloud services, SaaS, hyperscale datacenter footprint, and spending on public cloud datacenter hardware," he said in a statement, "but even so, these capex numbers took us by surprise. We have long said that this is a game of scale in which most service providers cannot hope to compete; here is some of the clearest evidence yet."

The total hyperscale capex for all of 2017 was $74 billion, according to Synergy, much of which was used to build and expand large datacenters, which have now grown to more than 420 worldwide.

[Click on image for larger view.] Source: Synergy

[Click on image for larger view.] Source: Synergy

The growth in spending on hyperscale during the first quarter of 2018, which surpassed all previous spending levels, is surprising because capex expenditures typically fall off during Q1 after a seasonal Q4 high. Q1 2018 saw sequential growth well over 20 percent, resulting in capex that was 80 percent higher than the first quarter of 2017.

"Even allowing for a large one-off item at Google, this would still have easily been a record-breaking quarter," the Synergy analysts wrote.

Google was, not surprisingly, the biggest spender, with Microsoft, Amazon Web Services (AWS), Apple and Facebook rounding out the top five, which in aggregate accounted for more than 70 percent of hyperscale capex. The spending levels at four of the big five were at an all-time high in Q1, the researchers found.

The Synergy research is based on analysis of the capex and datacenter footprint of 24 of the world's major cloud and Internet service firms, including the largest operators in IaaS, PaaS, SaaS, search, social networking and e-commerce. The list of big spenders in Q1 also included Alibaba, IBM, JD.com, NTT and Tencent. The report also noted significant hyperscale capex by several other companies, including Baidu, eBay, Oracle, PayPal, Salesforce.com, SAP, Yahoo Japan and Yahoo/Oath.

Definitions of "hyperscale datacenter" vary slightly, but essentially the term refers to facilities built with stripped-down, commercial, off-the-shelf computing equipment supporting millions of virtual servers called "nodes," that offer storage, software components and networking. A hyperscale datacenter solution is designed to provide a single, massively scalable compute architecture developed from individual servers. The hyperscale datacenter can accommodate increased computing demands in a smaller physical space, and with less cooling and electrical power.

Hyperscale has been getting a lot of press lately, and industry watchers are expecting the surge of Big Data and the demands of new cloud-based, data-driven applications to fuel significant growth over the next five years or so. Synergy's findings, though surprising in some ways, are consistent with that expectation.

About the Author

John K. Waters is the editor in chief of a number of Converge360.com sites, with a focus on high-end development, AI and future tech. He's been writing about cutting-edge technologies and culture of Silicon Valley for more than two decades, and he's written more than a dozen books. He also co-scripted the documentary film Silicon Valley: A 100 Year Renaissance, which aired on PBS. He can be reached at [email protected].