Record Quarter for PCs Amid COVID-Driven Buying

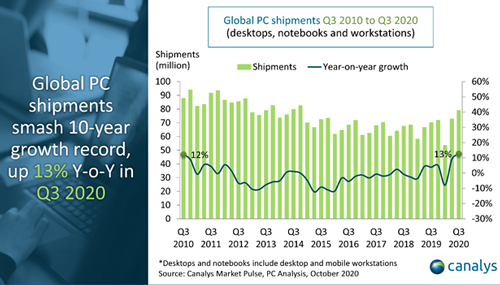

Market researchers from IDC, Gartner and Canalys released their respective third-quarter PC market estimates this week, and all indicators are pointing to record sales growth driven by the ongoing COVID-19 pandemic.

The three firms told similar stories -- heavy purchasing on the consumer side, robust activity around Chromebooks and education, and very strong growth in the United States. The result is growth levels not seen by the PC market for a decade.

For the third quarter, the growth reports were 12.7 percent from Canalys, 14.6 percent from IDC and 9 percent from Gartner. (Gartner's headline number was lower, 3.6 percent, but that figure didn't include Chromebooks.)

[Click on image for larger view.] Source: Canalys

[Click on image for larger view.] Source: Canalys

In fact, the numbers could have been better if it weren't for component shortages, according to Jitesh Ubrani, research manager for IDC's Mobile Device Trackers.

"Consumer demand and institutional demand approached record levels in some cases. Gaming, Chromebooks, and in some cases cellular-enabled notebooks were all bright spots during the quarter. Had the market not been hampered by component shortages, notebook shipments would have soared even higher during the third quarter as market appetite was yet unsatiated," Ubrani said in a statement.

Gartner research director Mikako Kitagawa suggests that it's time to start thinking about the consumer PC market differently, and in a way that could point to strong future growth: "The market is no longer being measured in the number of PCs per household; rather, the dynamics have shifted to account for one PC per person."

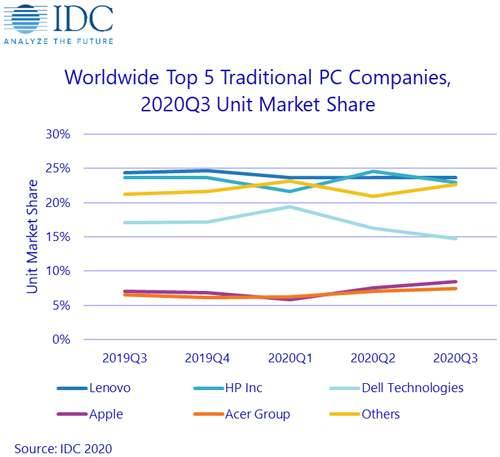

The business PC market was a different, not as strong, story in the third quarter, illustrated by Dell's performance. Among major PC vendors, Dell was the only one to decline, seeing shipments fall by a little less than 1 percent for the quarter, according to IDC's numbers. By comparison, Lenovo and HP were both up about 11 percent, Apple was up 39 percent and Acer was up 29 percent.

[Click on image for larger view.] Source: IDC

[Click on image for larger view.] Source: IDC

Gartner's news release on the numbers noted that Dell broke a streak of 17 consecutive quarters of year-over-year growth. "Dell's decline is one indicator of cautious spending by business buyers as a reaction to the current weak economies in most developed nations," the market research firm said in its statement.

Canalys Research Director Rushabh Doshi picked up on a nuance of the remote work reality that complicates the separation of the business and consumer PC markets.

"As the line between work and home lives is increasingly blurred, it becomes important to position devices towards a wide array of use cases, with a focus on mobility, connectivity, battery life, and display and audio quality," Doshi said in a statement. "Differentiation in product portfolios to capture key segments such as education and mainstream gaming will also provide pockets of growth. And beyond the PC itself, there will be an increased need for collaboration accessories, new services, subscription packages and a strong focus on endpoint security. These trends will most benefit vendors who provide holistic solutions that enable their customers to make structural changes to their operations."

In the near term, Doshi said the consumer-driven holiday season should make for a strong Q4 for PCs. But the Canalys analyst was bullish for the longer term, as well.

"The lasting effects of this pandemic on the way people work, learn and collaborate will create significant opportunities for PC vendors in the coming years," Doshi said.

Posted by Scott Bekker on 10/14/2020