IDC: Servers Up, Smartphones and PCs Down in Q4

The server business was booming in the fourth quarter of 2017, according to market research from IDC. PCs and smartphones, not so much.

IDC released a slew of reports this week recapping the most recently completed quarter, now that most of the publicly traded vendor companies have released their quarterly financial reports, with all those reports' attendant clues.

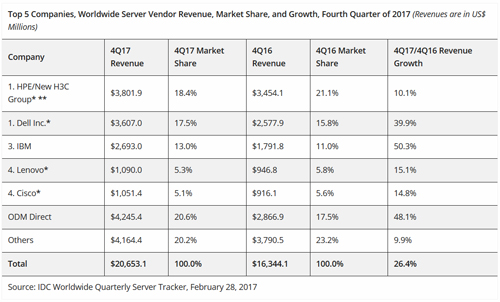

Server market revenues jumped 26 percent year over year to $20.7 billion in the fourth quarter. IDC attributed the momentum to several factors, such as traction for the Purley-based offerings from Intel and the EPYC-based offerings from AMD. The overall server market showed some signs of life, as well, with server shipments increasing nearly 11 percent to 2.84 million units for the quarter.

Yet the factor propping up the server market overall remains the shift in computing from distributed at client sites to centralized at megavendor datacenters.

"Hyperscalers remained a central driver of volume demand in the fourth quarter with leaders such as Amazon, Facebook, and Google continuing their datacenter expansions and updates," said Sanjay Medvitz, senior research analyst for servers and storage at IDC, in a statement. "ODMs [original design manufacturers] continue to be the primary beneficiaries from hyperscale server demand. Some OEMs are also finding growth in this area, but the competitive dynamic of this market has also driven many OEMs such as HPE to focus on the enterprise."

By manufacturer, the HPE/New H3C Group joint venture was tied with Dell for the quarterly revenue lead, followed by IBM, Lenovo and Cisco. Taken as a group, ODM Direct vendors had a slightly bigger share of revenues than either of the leaders.

[Click on image for larger view.]

[Click on image for larger view.]

The picture for personal computing devices, which IDC defines as desktops, notebooks, slates and detachables, wasn't as positive. IDC is projecting that for the full year of 2017, shipments within the sector declined 2.7 percent. IDC published forecasts out through 2022, and expects compound annual growth for the entire sector to be a paltry 0.1 percent over the period. Short-term, IDC is looking for another drop in 2018 of a little more than 3 percent, with slight pickups thereafter due to corporate refresh cycles, and the ongoing popularity of detachables like the Microsoft Surface.

As for smartphones, IDC reports that 2017 marks the first year-over-year decline for the devices, which are now in a two-horse race between Android and iOS. The 1.46 billion devices that IDC estimates shipped in 2017 represented a half-a-percent drop in volume compared to 2016. Through 2022, IDC forecasts a compound annual growth rate of a little under 3 percent.

Posted by Scott Bekker on 03/02/2018