In-Depth

Microsoft Enters Uncharted Waters with LinkedIn Acquisition

Microsoft is pursuing a new path with its $26.2 billion surprise deal to acquire LinkedIn. Many believe it's the catalyst Microsoft needs for growth, but skeptics question whether it'll work.

It was only a matter of time before Microsoft CEO Satya Nadella would pull off a blockbuster deal, but LinkedIn never surfaced as a likely acquisition target. Plenty of skeptics question Microsoft's surprise $26.2 billion all-cash deal to buy LinkedIn, by far Redmond's largest acquisition. Aside from LinkedIn shareholders, many have raised questions over who will benefit from this deal. Some outright believe such a pairing can never work, while others have taken a more neutral approach, saying they're unsure or don't know what to make of it. But despite the huge price tag and the combination of two different corporate cultures, many believe acquiring LinkedIn could be just what Microsoft needs to give it renewed relevance as enterprises look to become more digital and modernize how their workers do business.

Nadella and the CEO of LinkedIn, Jeff Weiner, along with its founder Reid Hoffman, believe the combined technology assets of both companies present a huge opportunity to change how professionals and organizations create, cultivate, maintain and leverage relationships.

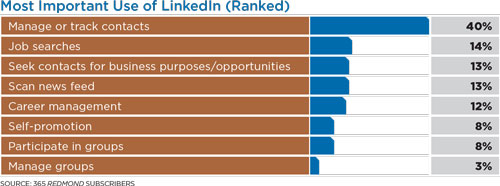

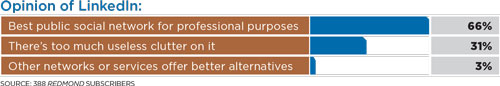

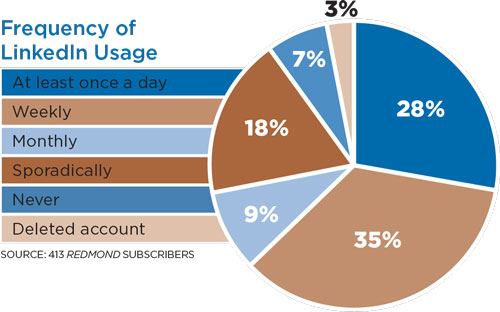

LinkedIn has its share of critics and its growth has slowed in recent years, but it's viewed as the best and by far most widely used public social network by professionals. LinkedIn claims more than 430 million professionals have accounts with profiles on its network and more than 100 million actively use it. "You're talking about the Rolodex of the world," IDC Executive VP and Head of Research Crawford Del Prete told Bloomberg TV on the day of the announcement. "There aren't that many networks with the kind of scale that these companies operate at."

"Massive Scaling"

While it's hard to see what direction this combined company might take and where the ultimate destination lies, LinkedIn CEO Weiner described it in a letter to employees as "massively scaling the reach and engagement of LinkedIn by using the network to power the social and identity layers of Microsoft's ecosystem of over 1 billion customers. Think about things like LinkedIn's graph interwoven throughout Outlook, Calendar, Active Directory, Office, Windows, Skype, Dynamics, Cortana, Bing and more."

Reaction to the deal in the first month after it was announced remained decidedly mixed. Wall Street analysts were cautiously optimistic that it could propel growth for Microsoft, and technology experts noted both companies have complementary user bases, capabilities and technology, while they each have similar mission statements.

"It's really about advancing how people and organizations get work done, finding the right people, and deploying the right people at the right time to meet the goal at hand," says Joshua Greenbaum, principal analyst with Enterprise Applications Consulting (EAConsult), a specialist in enterprise business applications. "That really is the next concept beyond let's hire and provision and deploy and fire." Greenbaum says the plan sounds good, but the onus is on Microsoft to execute. "It's a good concept, but I want to see exactly how Microsoft really plans to do that," he said.

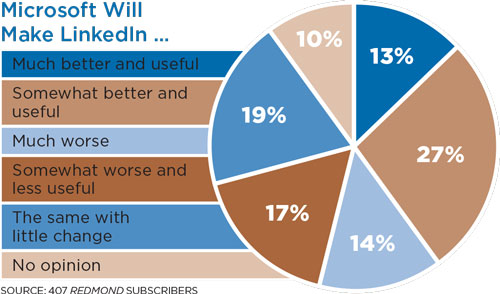

A survey last month of Redmond magazine subscribers found more than one-third of the respondents (37 percent) believe acquiring LinkedIn was a smart move by Microsoft that will live up to its promise of helping Redmond create new ways for people to connect through its core offerings, including Office 365. Only 22 percent believe it was a bad deal, with the remaining 42 percent saying it's either too confusing to predict or it has no obvious upside but poses little risk. A formidable number of respondents, 40 percent, believe Microsoft will make LinkedIn much or somewhat more useful, while 31 percent believe it will become much or somewhat less useful. The remainder don't anticipate significant change, or have no opinion. Among those skeptics participating in the Redmond survey was Eric Nail, a principal engineer with an insurance company, which he declined to identify. "I'm just not certain how LinkedIn will really add value to any existing Microsoft products, or how Microsoft will add value to LinkedIn's current platform/offering," Nail says. "This move is genuinely baffling."

Jonathan Wade, senior educational technologist at Western Carolina University, is another survey participant questioning whether the deal will pay off. "Microsoft believes that it can exploit the rich professional information and relationships that exist in LinkedIn to its advantage by marrying the tools it has with it," Wade says. "It feels a little far-fetched given the way people tend to use these tools. For example, a high-end or power user of LinkedIn may not gain much with the integration of Microsoft tools."

An Integrated Graph

Ruven Gotz, Avanade regional digital workplace lead and SharePoint MVP, says he initially had a hard time understanding the purpose of acquiring LinkedIn, but upon hearing leadership at both companies discuss their plan, he sees the potential, especially as it relates to creating a common graph. Gotz likes the idea of integrating the LinkedIn graph with Delve, the Microsoft Office Graph.

"The capability in Delve, which lets people search and surface things that they didn't even know they could search for, works inside an organization today," Gotz says. "Now imagine that you have the relationships with suppliers, vendors, clients, partners and others that are not inside your company. If it's potentially added to LinkedIn, it will let you extend outside the business walls to others and have those relationships, who am I meeting with and who am I sharing documents with. Therefore, it can use machine learning and the connections between people to make sure you see what you need to see or find what you're looking for. I think there's a lot of potential there."

On the morning of the June 13 announcement, Nadella told analysts that LinkedIn is a natural fit for Microsoft and its customers -- and a catalyst for growth Wall Street has long-awaited. "When we talk about Microsoft's mission, we talk about empowering every person and every organization on the planet to achieve more," Nadella said. "There is no better way to realize that mission than to connect the world's professionals to make them more productive and successful. That's really what this merger and this acquisition is about."

In his letter to employees, Weiner offered a similar view, saying the two companies have similar strategies. "Essentially, we're both trying to do the same thing but coming at it from two different places," Weiner said. "For LinkedIn, it's the professional network and for Microsoft, the professional cloud."

Some analysts believe the two will be able to scale in certain areas that neither could do as separate entities or even via a strategic partnership. One example is for organizations that do business-to-business sales and marketing. "They have a unique and proprietary dataset," says Forrester Research Inc. Analyst Steven Casey. "Now with the data sources available, you don't have to rely on a salesperson's Rolodex to understand who are the influencers on a B2B proposal team."

A prevailing question, though, is whether Microsoft needed to spend $26.2 billion to acquire LinkedIn, or if it could have formed an extended partnership with the company, like it has with Citrix, for example. Both parties found the need to deeply integrate their respective technologies and gain a competitive advantage. "We thought whether or not we could do it as a [business development] deal, and one of the problems is it's too deeply intertwined," Hoffman told CNBC last month. "So, actually combining the companies makes much more sense."

Addressing that question on the analyst call when the deal was announced, Nadella shared that view. "This deal is all about bringing together the world's leading professional cloud and the world's leading professional network," Nadella said. "If you think about how people work, it's split between these two worlds. The dream I have always had is how do we make this come together, so we can service our customers. If you look at Microsoft's footprint across over a billion customers and the opportunity to seamlessly integrate our network within the Microsoft cloud to create a social fabric, if you will, that can be seamlessly integrated into areas like Outlook, calendar, Office Windows, Skype, Dynamics and Active Directory, for us that is an incredible opportunity."

Social Selling

Both companies believe they can enter new markets such as recasting how CRM is implemented by advancing the notion of "social selling." LinkedIn's Weiner envisions integrating his company's Sales Navigator tool with Dynamics and various Microsoft capabilities in Office and many of the new features under development with Cortana.

"Social selling is something we have been focused on for several years through our Sales Navigator tools to provide business intelligence to sales people [which] enables them to take selling to social selling," Weiner told analysts. "That means being able to identify exactly the right process by virtue of leveraging data flowing through LinkedIn on a proprietary basis. It's connecting with that prospect, turning cold calls into warm prospects by virtue of leveraging the network to get the introduction, which can make all the difference in the world. It's tapping and understanding who that prospect is, to engage with them and reach out with them, and all of this is done and serves as greater sales efficacy and closing the deal. Now we will be able to take that business intelligence tool -- Sales Navigator -- [and] deeply integrate that into Dynamics and CRM, and we believe we can change the game that way."

Nadella also sees LinkedIn as an opportunity for Microsoft to recast itself in the CRM and business apps market. While Microsoft has played second fiddle to Salesforce.com Inc., SAP and Oracle Corp. in the market for business applications software and services, it appears the company is making a strong effort to compete, with last month's announcement of plans to release its Dynamics 365 modular Software as a Service (SaaS) and new AppSource marketplace this fall.

Christian Buckley, a SharePoint and Office 365 MVP and director of marketing at Beezy, sees potential in bridging the two worlds but cautions that Microsoft needs to not have too heavy a hand in trying to run LinkedIn. "If they could somehow make your LinkedIn profile your public-facing MySite, and use it somehow to bridge the gap between internal sites (Office 365, SharePoint) and external communities, it would give them a very powerful method of converting and upselling users into collaboration and Dynamics customers," says Buckley, who also blogs for Redmondmag.com. "The danger is that they mess it all up, bloating the features and breaking the UI, and then someone comes in and creates a business user community to compete -- something more in line with what LinkedIn is today, without Microsoft interference. For now, I like their idea of keeping things separate, and am interested to see what the strategy is for leveraging the data."

Best of Both Worlds?

LinkedIn founder Hoffman is enamored with the possibility of leveraging the technology assets, intellectual capital and vision of both companies to make that happen. Hoffman also sees LinkedIn's charter as complementary with Microsoft's. "Our mission is to connect the world's professionals to make them more productive and successful," Hoffman explained in a blog post. "As a professional, your network is your competitive advantage: in skills, in intelligence, in opportunities, in connection and in collaboration. In this networked age, it is the key advantage. When you marry our mission with Microsoft's mission, to empower every person and every organization on the planet to achieve more, it's impossible to not imagine the massive opportunity for our members and customers."

In his letter to employees, Nadella summed up where he envisions taking the combined company: "In essence, we can reinvent ways to make professionals more productive while at the same time reinventing selling, marketing and talent management business processes."

About the Author

Jeffrey Schwartz is editor of Redmond magazine and also covers cloud computing for Virtualization Review's Cloud Report. In addition, he writes the Channeling the Cloud column for Redmond Channel Partner. Follow him on Twitter @JeffreySchwartz.