News

PC Market Projected To Continue Downward Sales Trend

According to a Gartner analysis report released this week, total PC shipments worldwide are expected to decline by over 8 percent in 2013, compared to last year.

Gartner's findings, released Monday, punctuate a disappointing year for PC shipments, which have declined in each of the past three quarters compared to their corresponding year-ago periods. Invariably, analysts have pointed to growing demand for smaller devices (i.e., tablets and smartphones) as one key reason for falling PC demand.

The research firm's end-of-the-year projections seem to bear this out. Combined, shipments of traditional PCs (which comprise desktop and notebook computers, according to Gartner's definition) and "ultramobile" notebooks (which include Intel Ultrabooks and other thin and lightweight PCs) are expected to total roughly 322 million units in 2013, down 8.4 percent from the 351 million units shipped in 2012.

By comparison, worldwide tablet shipments are projected to balloon by over 53 percent, reaching 184 million units by year's end. Mobile phone shipments are also expected to increase year-over-year, though by a more sedate 3.7 percent.

Gartner cited demand for lower-price and smaller devices as driving growth in the tablet and mobile phone markets. For tablets, Gartner said "premium" tablet models are facing competition from lower-priced 7-inch tablets. In a recent survey of 21,500 consumers worldwide, the firm noted that nearly half of respondents owned an 8-inch-or-smaller tablet device.

For mobile phones, price seems to be a bigger factor. "The opportunity for high average selling price (ASP) smartphones is now ending," according to Gartner. "Growth is expected to come from mid-tier smartphones in mature markets and low-end Android smartphones in emerging markets."

On whether Microsoft's acquisition of Nokia's device manufacturing business will have any impact on the smartphone market, Gartner said no.

"Windows Phone challenges in the smartphone market remain the same, with the need to bring on board more developers and enrich the ecosystem, as well as turning the Windows Phone brand into a cool smartphone brand. While there are clear benefits to the acquisition, such as channel strength, carrier relationship and emerging-market knowledge, the brand and ecosystem do not directly benefit from it," said Carolina Milanesi, research vice president at Gartner, in a prepared statement.

The bright spot for the PC market is in the ultramobile space. When broken out from the larger PC category, ultramobile shipments are expected to grow by an impressive 90 percent in 2013 compared to 2012. Between 2013 and 2014, Gartner projects the ultramobile category to grow by another 114.5 percent, totaling nearly 40 million units.

Gartner noted that PC manufacturers are likely transitioning their production focus to new ultramobile devices powered by Intel's Haswell and Bay Trail processors. Both Microsoft and Intel have said they expect these processors to enable PC manufacturers to produce lighter, more power-efficient and lower-cost devices. However, these improvements do not necessarily guarantee a late-game surge in the ultramobile space before year's end, according to Gartner.

"While consumers will be bombarded with ads for the new ultramobile devices, we expect their attention to be grabbed but not necessarily their money," Milanesi said.

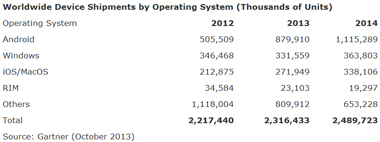

In terms of operating system market share, Microsoft Windows trails Google Android, but leads Apple iOS and MacOS (see table). The overall down market for PCs has hurt Windows' market share in 2013. Windows is expected to ship on 332 million devices worldwide by year's end, a 4.3 percent drop from 2012. Its market share is expected to hit 14.3 percent in 2013, down from a 15.6 percent market share in 2012.

Meanwhile, Android is expected to capture 38 percent of the global market in 2013, shipping on 880 million devices. That's up from its 22.8 market share in 2012, when it shipped on 506 million devices.