In-Depth

2017 Marching Orders: IT Spending on the Rise

IT spending is expected to rise this year, but how those expenditures are allocated will continue to change with a good chance of surprises.

Predicting what's next in IT is in some ways like trying to forecast the weather. Most forecasts are on target or close, though some are not as precise as others.

Occasionally a storm will veer in a different direction than expected due to unforeseen circumstances. Likewise, trying to predict what's next in IT comes with caveats. Expectations of advances in technologies are skewed when it turns out some were surrounded by more hype than promise or when they're not released when expected.

Last year's predictions that Windows 10 migrations would start to pick up in the second half, that DevOps would become more important and the political noise would weigh heavy in IT were generally prescient. Likewise, it was no surprise -- yet no less alarming -- that addressing new cyber threats would only become more challenging. But the extent to which the move toward automation, intelligent bots, conversational computing, AI, predictive analytics, containers, IoT, hyper-scale computing and virtual reality would surface was greater than we've seen in many years.

Many of these developments will remain on the agenda in 2017 and beyond as organizations realize increased expectations to become more productive and to automate more business processes than ever. Yet, these technologies generated enormous hype and, while many organizations will begin evaluating and perhaps testing them this year, others are looking at making their operations and their employees more productive. And while 2016 was full of surprises, it's likely that this year will have its share of unexpected developments.

Impact of the New President

Amid a push to embrace new forms of computing and managing infrastructure, as the new year kicks off, the United States will have a new president for the first time in eight years. While it's difficult to predict what impact the new administration will have on technology, the markedly different views of President-elect Donald Trump from the man he will succeed, President Barack Obama, is bound to affect IT this year and into the future. Trump's stated policy and his cabinet picks point to likely attempts to bring changes in policy in such areas as encryption, net neutrality and privacy. Likewise, immigration and new economic policies will have an uncertain impact on employment, taxes and the prospect of letting large IT providers repatriate their cash reserves that are offshore.

Given Trump's pattern of changing his mind, IT decision makers in some industries may move forward with spending more cautiously, predicts Forrester Research Inc. analyst Andrew Bartels. Following the unexpected victory by Trump in November, Forrester revised downward its 2017 IT spending growth forecast from 5.1 percent to 4.3 percent. Business technology spending will increase 7.7 percent while core IT expenditures will increase 2.8 percent, Forrester is now forecasting.

"If the post-election uncertainties about federal policies and the economy are moderating forces on the tech market, an accelerant is the BT agenda of technologies to attract, serve, and retain customers," Bartels wrote. "In an economy where strong consumer spending is likely to be a reality, customer-facing investments make a lot of sense to business executives." New project spending will make up 29 percent of IT spending, with business technology initiatives accounting for 54 percent of that new project spend this year, Bartels noted.

The impact of Trump's new policies will most likely show in 2018, according to Bartels. This year, business technology projects will drive IT spending, with investments focused on data, analytics, mobile and cloud. "The accelerating shift to cloud software will dampen overall tech market growth as Software-as-a-Service (SaaS) subscription spending cannibalizes license and maintenance fees," Bartels noted. The most aggressive spenders will be media and entertainment companies, insurance carriers and health care organizations. Government spending will flatten, according to Bartels, while lower oil and gas prices are likely to result in lower IT spending among energy companies. Pharmaceutical companies and wholesalers are likely to rein in costs, while uncertainty will at least stall some retailers and manufacturers.

Overall IT Spending to Rise

The outcome of the election wasn't factored into this year's worldwide IT spending forecast from Gartner Inc. John-David Lovelock, VP of research at Gartner, said in a statement prior to the election that regardless of who wins, the outcome should have little impact on IT spending. "Typically, there is a slight pause in IT spending leading into the election, and then a relief in spending, subsequently. However, trends have shown that IT spending in the U.S. is not dependent on presidential leadership, so neither candidate should have a significant impact on IT spending in the near-term." The one variable is that Lovelock's statement presumed the Federal Reserve might cut interest rates, but at press time the indicators suggested an increase was likely, which could impact financing costs, though not markedly.

Gartner's annual worldwide forecast predicts IT spending will increase 2.9 percent in 2017, totaling $3.5 trillion. While that's a nominal rise, it represents an improvement over last year when spending was flat (technically it declined by 0.3 percent). Unlike Forrester, Gartner's forecast doesn't include IT staffing.

Gartner predicts software spending will experience the highest growth, jumping 7.2 percent to $357 billion, while IT services expenditures of $943 trillion will show growth of 4.8 percent. Expenditures on datacenter technology of $177 billion will show a nominal increase of 2 percent, though still a tad better than last year's 1.2 percent increase.

Some areas that showed declines in spending last year are expected to show positive increases in 2017, according to Gartner. Communications services, accounting for the largest piece of the pie, had declined 1.1 percent last year, but are poised to rise 1.9 percent to 1.4 trillion in 2017. Perhaps the most noteworthy turnaround will be in devices, where spending declined 7.5 percent in 2016, but are forecast this year to grow 0.4 percent with an anticipated $600 billion in sales.

IDC's most recent report on tablets published last month forecasts that worldwide tablet shipments declined 12 percent last year and doesn't expect the tablet market to rebound until 2018, and even then, it will be in the single digits with the pull coming from detachable devices. The majority of tablets will remain Android-based, according to IDC. The breakdown of tablets last year was projected at 66.7 percent for Android (121 million units), with iOS-based iPads accounting for 23.6 percent (43 million units) and Windows-based tablets making up 9.6 percent (17.5 million units).

While Windows trails behind Android and iOS in the tablet market, it's up nearly a percent from last year and expected to account for 19.2 percent of tablets shipped by 2020, at the expense of Android, which will drop to 57.5 percent. iOS is expected to remain flat at 23.3 percent. "Windows tablets will gain traction over time mainly because the detachable form factor is also expected to grow," said Jitesh Ubrani, senior research analyst for mobile devices at IDC.

Windows 10 on the Fast Track

Declines in PC sales appear to have bottomed out earlier this year. In its most recently published PC Tracker report, IDC noted declines of 3.9 percent in the third quarter of 2016 were a surprising 3.2 percent higher than expected. In in its fourth quarter PC tracker report a year ago, PC sales declined more than 11 percent. IDC credits improved designs, added features and faster processors for contributing to the uptick that it believes will continue incrementally this year. Another key contributor is anticipated Windows 10 upgrades.

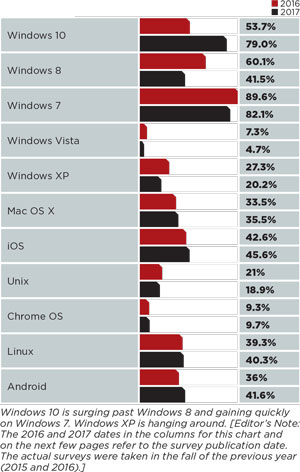

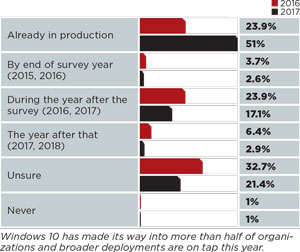

A survey of Redmond magazine readers conducted in November found that 79 percent now have at least some Windows 10-based systems deployed in their organizations, up from 53.7 percent, who gave that same response last year (see Figure 1). Falling most precipitously this year will be Windows 8/8.1-based systems to 41.9 percent from 60.1 percent last year. At the same time, 82.1 percent will still have Windows 7 in their organizations, down from 89.6 percent last year, and 20.2 percent still claim to have some Windows XP systems in production, down from 27.3 percent. When asked what their deployment plans are for this year, 51 percent said they'll already have Windows 10 in production this year, compared with 23.9 percent when asked last year (see Figure 2).

[Click on image for larger view.]

Figure 1. Client OSes in Use

[Click on image for larger view.]

Figure 1. Client OSes in Use

[Click on image for larger view.]

Figure 2. Plans to Deploy Windows 10

[Click on image for larger view.]

Figure 2. Plans to Deploy Windows 10

Likely to accelerate deployments is the fact that that Microsoft issued the Windows 10 version 1607 "Anniversary Update" "current branch for business" release (see Redmond Report, p. 4). A variety of factors are motivating organizations to upgrade to Windows 10. A key reason is while Windows 7 remains popular, mainstream support is set to end in 2020 and organizations don't want to face the same issues when Microsoft stopped supporting Windows XP. Improved security is another reason and many have aging PCs that need to be upgraded.

Yet many IT professionals are wary of Windows 10 and Microsoft's new Windows as a Service centered on continuous updates. Though it's no different than the way Apple routinely updates iOS or Google updates Android, Windows administrators are not accustomed to this model, according to MVP Greg Shields, an author evangelist at Pluralsight and a former Redmond magazine columnist.

"IT pros are going to get used to seeing this rapid cadence we're seeing with Windows 10 and Server 2016," Shields says. "Right now, we institutionally don't grok yet the idea of what this means. It's going to take us more than a year to really wrap our arms around it and [know] what our new operational processes are going to be so that we could actually fulfill this idea of regular cadence coming out of Microsoft."

As a trainer and co-chair of the TechMentor conferences, which are produced by Redmond parent company 1105 Media Inc., Shields says he hears a lot of fears about this change. "Microsoft wants people on the continuous update and a lot of them will fight it," Shields says, adding that, like everything, IT pros will learn to embrace it. "After a while, people who fought it will figure out it's not so bad."

Windows Server 2016 Enters the Datacenter

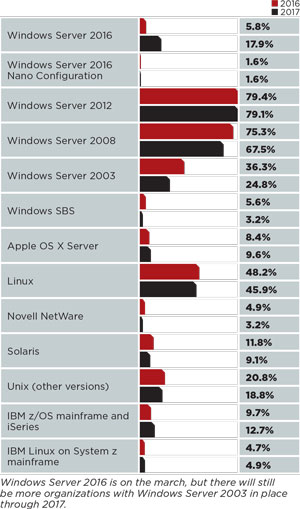

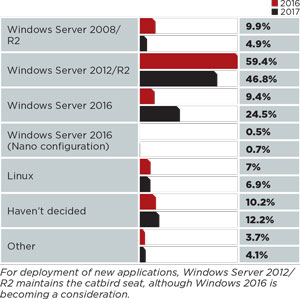

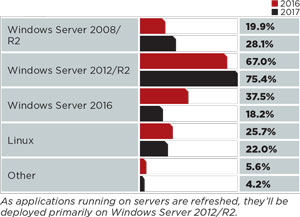

IT pros who manage Windows Server 2016 will experience the same changes and even more so for those who deploy the Nano Server configuration option. Hardly anyone, only 1.6 percent of respondents to our survey, plans to deploy the Nano Server configuration, compared with 46.8 percent, who currently have Windows Server 2012/R2 deployed (see Figure 3). Yet 17.9 percent already have Windows Server 2016 deployed, compared with last year's 5.8 percent. When it comes to deploying new applications, 24.5 percent said they plan to run it on Windows Server 2016, compared with 46.8 percent who plan to stick with Windows Server 2012/R2 and 4.9 percent still plan to roll out new applications on the aging Windows Server 2008 R2 (see Figure 4). A mere half of a percent said they plan to deploy new applications using the Windows Server 2016 Nano configuration option. That wasn't a surprise to Shields. "No one's going to use Nano Server yet," he said. "It's not a thing," in relation to his contention (and that of others) that it's not ready for mainstream deployment.

[Click on image for larger view.]

Figure 3. Server OS Deployment Plans

[Click on image for larger view.]

Figure 3. Server OS Deployment Plans

[Click on image for larger view.]

Figure 4. Server Platform Choice for New Applications

[Click on image for larger view.]

Figure 4. Server Platform Choice for New Applications

Perhaps the biggest surprise to those upgrading to Windows Server 2016 is the new pricing model Microsoft has implemented for it. Commencing with the recent release of Windows Server 2016, Microsoft is moving from per-processor licensing to pricing on a per-core basis. The standard and datacenter editions require a minimum of 16 cores, with pricing per core starting at list prices of $882 for the former and $6,155 for the latter. Both require CALs, as well.

Adding to the sticker shock, the Standard edition is not going to fit most enterprise deployments, said speaker and author Mark Minasi, an MVP who gave the keynote address about Windows Server 2016 at last month's TechMentor conference, held in Orlando, Fla. "You're not going to buy standard server because all of the new features are not in standard server. You've got to buy datacenter server," Minasi said.

Another major change in Windows Server 2016 is that administrators will find they can't control many of its features with a GUI, meaning they'll have to use more PowerShell commands. "Basically, if you are going to be a Server 2016 administrator, you're using PowerShell," Minasi said. "And let's be very clear, that's a good thing." Minasi also warned that those considering deploying the Nano Server option should make sure they want to do that. "When you make that decision, you can't go back," he said. "If you decide you really need the GUI, too bad you can't reinstall it."

Office 365 Goes Wide and Deep

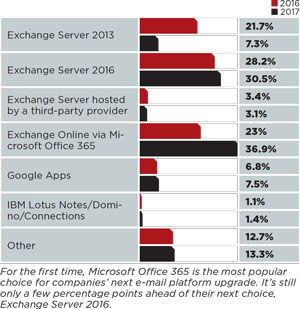

It's hardly surprising that more organizations are deploying Office 365. Gartner analyst Mark Diodoti says 70 percent of the IT research firm's clients plan to deploy Office 365 in the first six months of this year. Our survey looked more specifically at whether organizations were deploying Office 365 to replace or extend Exchange Server and SharePoint Server, respectively. Nearly 37 percent said they will deploy Exchange Online via Office 365, compared with 23 percent who planned to switch to the service last year (see Figure 5).

[Click on image for larger view.]

Figure 5. E-mail Platform Upgrades

[Click on image for larger view.]

Figure 5. E-mail Platform Upgrades

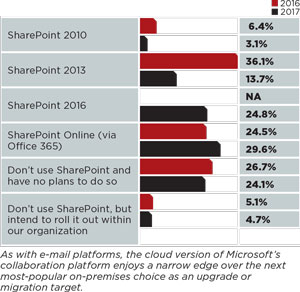

At the same time, not everyone is moving from their on-premises Exchange Server deployments. Our survey shows that 30.5 plan to upgrade to Exchange Server 2016. A small handful, 7.3 percent, will add Exchange Server 2013. Likewise, a remarkably low percentage of respondents are moving to Google Apps. A somewhat smaller number of respondents, 29.6 percent, are planning to move to SharePoint Online, with a greater percentage planning to deploy SharePoint Server. However, that majority is spread across three versions, with 24.8 percent opting for the new SharePoint 2016 released last summer and 13.7 percent sticking with SharePoint 2013. Collectively, with 3.1 percent planning on adding a SharePoint 2010-based system, a total of 40.6 percent plan to deploy one of the server versions.

Whither the File Server?

The market for cloud services continues to accelerate. Forrester is now forecasting that spending on public cloud services will rise 29 percent this year to $146 billion, up from $114 billion in projected spending in 2016. The growth will come from cloud platforms, which include both Infrastructure as a System (IaaS) and Platform as a System (PaaS), according to Forrester's forecast. Forrester said the second key growth category is what it calls cloud business services, comprising database, application integration, file management and communications. Also included in that category are testing, disaster recovery, desktop and billing services. Forrester also anticipates a continued move from traditional on-premises software and infrastructure to SaaS-based alternatives.

"In the past two years, companies have started to deploy cloud resources as a replacement for internal systems in much higher numbers, according to Bartels and Forrester analysts Bartoletti and John Rymer, who co-authored the cloud study. "For example, swapping out SAP HR systems with a Workday HR system or replacing on-premises servers and storage arrays with cloud-based compute and storage services."

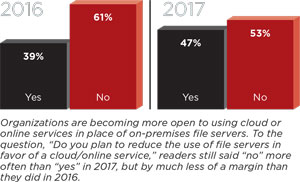

Respondents among the Redmond readership survey also are increasingly replacing their file servers with cloud services (see Figure 6). Last year, 39 percent said they planned to replace their file servers with a cloud-based service. In 2017 that number increased to 47 percent. It's a reasonable bet that more than a majority of respondents will do so in 2018.

[Click on image for larger view.]

Figure 6. Replacing File Servers with Cloud Services

[Click on image for larger view.]

Figure 6. Replacing File Servers with Cloud Services

[Click on image for larger view.]

Figure 7. Server Platform Choice for Application Refreshes

[Click on image for larger view.]

Figure 7. Server Platform Choice for Application Refreshes

[Click on image for larger view.]

Figure 8. SharePoint Upgrades and Migrations

[Click on image for larger view.]

Figure 8. SharePoint Upgrades and Migrations