News

Microsoft Q2 Earnings Up, but OEM Sales Decline

Microsoft reported second quarter earnings for fiscal-year 2015 today, largely meeting analyst expectations.

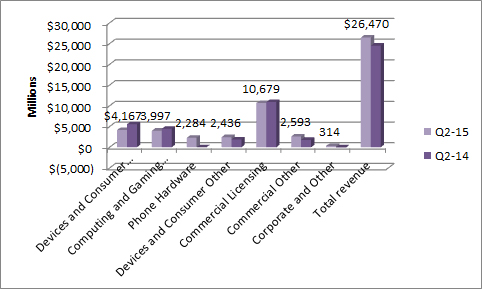

Revenue for the quarter, which ended on Dec. 31, 2014, was $26.47 billion, up 8% from the year-ago second quarter. Diluted earnings per share was $0.71, down 9%. Analysts had expected $26.3 billion in revenue and $0.71 earnings per share.

Once again, like last quarter, Microsoft reported a negative pull on its financial results because of the costs associated with its July 2014 restructuring efforts, along with its Nokia integration. Those costs pushed earnings per share down by $0.02.

While overall earnings were up, the Devices and Consumer business segment was down year over year (see chart). There was a 13% decline in "Windows OEM Pro revenue" and a 13% decline in "Windows OEM non-Pro revenue" for that segment, according to Microsoft's Q2 report.

Microsoft's fiscal Q2 2015 revenues by segment. Source: Microsoft investor relations site.

Microsoft's fiscal Q2 2015 revenues by segment. Source: Microsoft investor relations site.

Microsoft's report, though, claimed that revenue from the Devices and Consumer segment actually grew 8% to $12.9 billion. The company earned $1.1 billion from Surface device sales, up 24%. It reported Phone hardware revenue of $2.3 billion, with 10.5 million Lumia device sales.

Microsoft now has 9.2 million subscribers to its Office 365 Home and Personal editions, as well as a total of 6.6 million Xbox units sold, according to its Q2 report.

The Commercial business segment had a 5% increase to $13.3 billion in revenue for the quarter. Server products showed a 9% growth, while Windows volume licensing revenue grew by 3%.

Commercial Office suite product revenue decreased by 1%. The decrease was due to some organizations switching to Office 365 services, plus a pause in PC buying following Windows XP refreshes, according to Microsoft's report.

Microsoft's Q2 earnings reports can be found at this page.

About the Author

Kurt Mackie is senior news producer for 1105 Media's Converge360 group.