News

Microsoft Clarifies Its Restructuring at Financial Analyst Meeting

Microsoft explained nuances regarding its restructuring efforts at its annual Financial Analyst Meeting on Thursday.

The company is remaking itself as a devices and services company, which Microsoft CEO Steve Ballmer announced late last year, following an earlier move to the cloud. Ballmer also had previously announced details about a "One Microsoft" plan back in July in which four new engineering groups were created. On Thursday, financial analysts heard a lot more about what all of these changes will mean with regard to the company's reporting and operations.

The event featured talks by Ballmer and other high-level executives. Ballmer announced his retirement plans last month, but no details about the search for his successor were publicly shared at the meeting. Ballmer had previously said that he was stepping down for someone else to lead the One Microsoft transition. He explained during the Financial Analyst Meeting that he had spent three years getting to know the senior leaders of Microsoft's competitors, but he also suggested that Microsoft had internal talent that also could fill his shoes. Ballmer said he owned four percent of Microsoft's stock and was "long on Microsoft."

Microsoft's New Structure

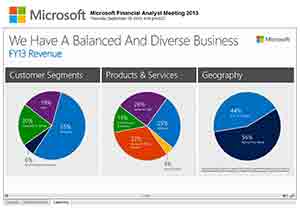

Microsoft will have five new reporting segments, grouped under "Devices and Consumer" and "Commercial" categories (see Figure 1). Microsoft newest Form 8-K (PDF), explains how the company's various products will get categorized for reporting purposes. The idea, ostensibly, is to better explain to investors how Microsoft's consumer and enterprise products are performing.

[Click on image for larger view.] Figure 1.

[Click on image for larger view.] Figure 1. Microsoft's five new reporting segments.

The Devices and Consumer category has three segments: Licensing (Windows and Windows Phone); Hardware (Xbox 360, Xbox Live, Surface and PC accessories); and Other (Windows Store, Xbox Live, Windows Phone Marketplace, subscriptions to Office 365 Home Premium and games).

The Commercial category has two segments: Licensing (Windows Server, SQL Server, Visual Studio, System Center, Windows Embedded, Microsoft Office, Exchange, SharePoint, Lync, Skype and Microsoft Dynamics excluding Dynamics CRM Online); and Other (Enterprise Services, Premier Services, Consulting Services, Online Services, Dynamics CRM Online, Windows Azure and Office 365 excluding Office 365 Home Premium).

The new reporting reflects the way Microsoft now conceives of its business efforts, according to Amy Hood, Microsoft's new chief financial officer.

"You should report the business the way your CEO manages the business," she said. "But beyond that, beyond that principle, our goal is to show the transitions in the business model we've just talked about clearly. The goal is to show the progress we're making on devices and services more clearly. And the goal is to show more accountability to the gross margin profiles we're changing."

Hood said that 2014 will reflect Microsoft's ongoing transition to cloud. She briefly mentioned Microsoft's $7.18 billion Nokia acquisition, saying that by 2014, "I hope we will be the owner of Nokia."

High-Value Activities Focus

The main idea of the reorganization is for Microsoft to focus on "high-value activities," which was a term used by both Hood and Ballmer in describing the reorganization.

"We spent the last six months as a leadership team more engaged time-wise than we have ever been, not sort of beating out what a reorganization looks like, but really fundamentally honing the strategy, the strategy first and foremost of focusing in on high-value activities," Ballmer said. He added that it will be easiest for Microsoft to monetize devices and enterprise services as high-value activities, but monetizing consumer services would be "tough." However he noted that consumer services represented "a path to enterprise services" for Microsoft from a strategic perspective.

Microsoft is putting its Windows platform first, but Ballmer suggested that it aims to broaden the platform support for its various products.

"We can lead with our enterprise services but our customers will require us to support other platforms, and we're doing so," Ballmer said. "Or we can lead with our devices, particularly in the consumer market, and even so if we want people to adopt our services there's a requirement that we support some other platforms."

Microsoft by the Numbers

Kevin Turner, Microsoft's chief operating officer, explained during the event that Microsoft's Windows business is just the company's third most profitable business segment now, with the Office and Server and Tools Divisions leading (see Figure 2).

[Click on image for larger view.] Figure 2.

[Click on image for larger view.] Figure 2. Microsoft's customer segments.

Turner's presentation was interrupted, in part by a power outage, but he managed to deliver plenty of statistics for the number-crunching crowd to consider. Early on in his talk, he gave an update on Windows XP, Microsoft's 12-year-old operating system that will lose support in April. Its popularity has been hanging on, but Turner said that Windows XP use was "down to 21 percent worldwide, and we have plans to get that number to 13 percent by April when the end-of-life of XP happens."

Turner's talk at the Microsoft Financial Analyst Meeting included the following highlights.

Consumer services: 13 percent growth in consumer cloud users year over year; 5.6 billion Bing queries per month with almost 27 points of U.S. market share in search; 460 million MSN users; 48 million Xbox Live members; 320 million Skype users with Skype driving a third of all international phone traffic; 400 million Outlook.com users; 250 million SkyDrive users.

Enterprise services: 1.5 billion Office 365 run rate ("fastest-growing product we've ever had"); Office 365 deployed seats at over 350 percent in fiscal-year 2013; one million U.S. government employees moving to Office 365; Windows Azure growing at 200 percent, with half of the Fortune 500 now using it; Dynamics CRM Online business growing over 80 percent.

SharePoint and Lync: SharePoint used by two of three information workers worldwide; Yammer used by 85 percent of the Fortune 500; Lync used by 90 of the Fortune 100 companies.

Windows Phone: up 900 percent in Latin America, 400 percent in India, 300 percent in China, 300 percent in Asia-Pacific, and 700 percent in Middle East and Africa.

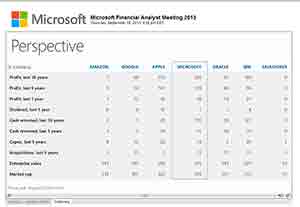

Another slide (Figure 3) shown by Turner showed Microsoft generating more profit than some of its competitors over the last 10 years. Ballmer later said that there were not too many "big things" remaining to capitalize on, and that Microsoft's competition had mostly succeeded in the past by exceling in one particular area.

[Click on image for larger view.] Figure 3.

[Click on image for larger view.] Figure 3. Microsoft's profit over last 10 years.

Turner argued that Microsoft would gain more wallet share from its cloud focus. He claimed that Microsoft's Hyper-V was gaining on VMware's virtualization solutions by growing at three times VMware's rate. On the devices and services front, Turner claimed that Microsoft was growing its market by branching out from the desktop PC.

"In the new world, when you add up the PCs and the ultra-mobiles, the tablets, and the phones, and the embedded devices, we actually see that opportunity much different," Turner said. "In the devices and services world, the opportunity is really around 2.7 billion devices by 2015 or '16. So we go from really benchmarking ourselves and having the opportunity to participate in 300 million devices to almost 2.7 billion devices. That's the power that we get on being in the devices and services business."

The event also featured a panel session of Microsoft executives. Transcripts, slides and recordings from the Microsoft Financial Analyst Meeting can be found at this page.

About the Author

Kurt Mackie is senior news producer for 1105 Media's Converge360 group.