Amazon's Cloud Services Continues Exponential Growth

At its first-ever customer and partner gathering, Amazon Web Services officials this week were loud and clear in their assertion that corporations and the public sector should hasten their transition from operating traditional datacenters to instead running their infrastructures in Amazon's rapidly growing cloud service.

While Amazon is already the leading cloud infrastructure provider, the company used its re:Invent conference in Las Vegas to crank up the volume on its message that its vast array of cloud-based compute, storage and application services offer unlimited capacity and elasticity, coupled with its infrastructure-on-demand architecture. It showcased many customers that are already doing so such as Netflix, Nasdaq and the team of NASA and Jet Propulsion Laboratories, along with 300 government agencies, as well as newer companies such as Dropbox, Pinterest and Spotify.

By shifting more workloads to Amazon's cloud services, company officials emphasized that organizations can lower their IT costs by reducing or eliminating capital expenditures and moving to an operational expense model. Such a shift will also let them be more agile to the needs of the business, the officials emphasized.

Of course this pitch is hardly anything new to anyone who has followed the growth of cloud computing over the past five years. But the typically low-key Amazon came out swinging at re:Invent in an effort to leave little doubt that its cloud operation is not just a side business of the much more prevalent Amazon.com online retail site.

In fact, Amazon officials suggested they are aiming to marginalize what they called "old guard technology companies" like EMC, Hewlett Packard, IBM and Oracle, among others. "The economics of what we're doing are extremely disruptive for old guard technology companies," said Andy Jassy, senior VP of Amazon Web Services, in yesterday's opening keynote address. "These are companies that have lived on 60 to 80 percent gross margins for many, many years, and in fact they set expectations that that's what they are doing. This is what they communicate externally."

One might dismiss such statements as rhetoric except Amazon has a track record of putting the squeeze on its rivals. Its online retail operation has redefined the business models of such players as Barnes & Noble and Best Buy, while contributing to the demise of Borders, Circuit City and CompUSA .

"High-margin businesses have been around forever in lots of industries and they are obviously a very valid and successful business model," Jassy said. "It's just not ours. It is radically different to run 60 to 80 percent gross margin business than a high-volume, low-margin business. "The vast majority of computing over the next 10 years, it stands to reason, is going to be a high-volume, low-margin business."

Forrester Research analyst James Staten, who was at re:Invent, said in a telephone interview that Amazon's volume business model calls for 10 to 12 percent margins. "If you look at all the other competitors out there, they are coming from high-margin businesses that are not high volume, and they are trying to see how to navigate or bring into their business a low-margin, high-volume business as a compliment and that's just really tough," Staten said. "Most of these guys are trying to figure out how they can do that or if they need to do that or how fast they need to do that."

Jassy also made light of private and hybrid clouds suggesting they are merely efforts by entrenched IT providers to preserve existing business models, while failing to offer the benefits of operating IT as a service. "Why are these old guard technology companies so desperately trying to get you to buy the private cloud?" he asked. "Why? I think the answer is, the economics of what we're doing are extremely disruptive for old guard technology companies."

As Amazon's cloud business grows, company officials said the economics of offering its services expands by virtue of the fact that they are adding more capacity and therefore able to offer it at lower cost. For example, since launching its Simple Storage Service, known as S3, the company has reduced the price 24 times, the latest taking effect yesterday. The company slashed its storage rates on average 25 percent. "They've made it so storing almost anything in Amazon is cheaper than storing it in your own datacenter," Staten said.

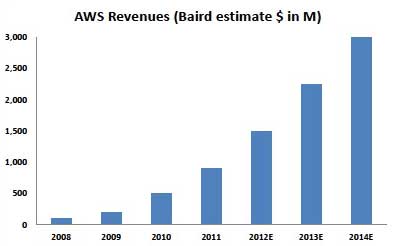

Amazon is regarded as the largest provider of cloud infrastructure services. While it doesn't break out the revenues for its cloud business, the investment research firm R.W. Baird estimated in a research note this week it will be a $1.5 billion business this year. Within two years, that business will double to $3 billion, R.W. Baird has forecast.

|

Figure 1. AWS financial forecast from R.W. Baird. Source: R.W. Baird. |

In his keynote today, Amazon CTO Werner Vogels echoed Jassy's sentiment that the company is aiming to change the economics of datacenter operations with its cloud offerings. "Being constrained by hardware makes it impossible to do the things you want to do as a business," Vogels said.

Still, despite growing use of cloud computing, Amazon and other cloud providers still face a skeptical audience of IT decision makers, Forrester's Staten warned. "The biggest problem they face is many enterprises only know Amazon as an online retailer," Staten said. "They have significant amount of skepticism about this non-enterprise player being able to support their enterprise game."

Posted by Jeffrey Schwartz on 11/29/2012 at 1:14 PM